Trying to navigate the legal system when you’re going through a separation or a divorce doesn’t have to be frustrating and confusing. Our Simple Article & Infographic should help clarify a few misconceptions when it comes to binding financial agreement vs consent order.

Whilst the decisions you make at this point in your life will affect your family’s future, it is possible to move forward feeling confident that the agreements you sign will protect your family.

When you’re ready to divide your property, there are two ways to turn your decisions into a legally binding agreement:

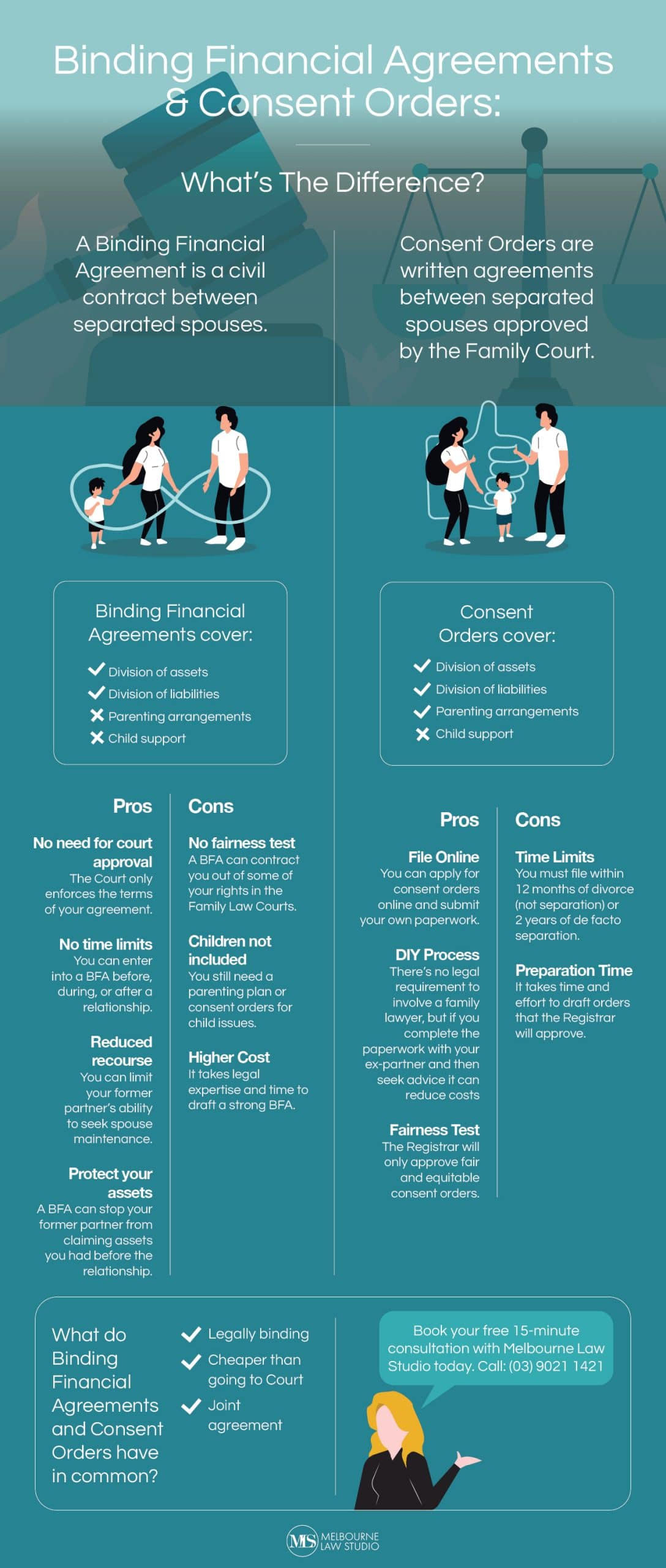

On this page, we’ll help you understand the differences between these two courses of action, as well as the advantages and disadvantages of each option - our helpful infographic below should help illustrate the main points you should keep in mind when deciding.

We’ll also be answering some commonly asked questions about creating consent orders and signing a Binding Financial Agreement after separation or divorce.

Or, if you’d prefer to talk to someone about your situation you can reach out to the team at Melbourne Law Studio for family law advice. We offer online or in-person consultations.

Simply call (03) 9021 1421 or book online now.

Learn about Binding Financial Agreement Vs Consent Orders

Whether you are in the process of getting a divorce or separating, “consent order” is a phrase you will no doubt become familiar with. A consent order is a written agreement between separated spouses that gets approved by the Family Court. They can address financial matters such as property and superannuation as well as parenting.

Where parenting is being agreed upon, this agreement contains arrangements for how you will both parent your children moving forward, including how parents will:

You can’t, however, include anything related to child support in consent orders - those arrangements need to be outlined in a Parenting Plan or assessed by Services Australia.

Where property is concerned, consent orders are used to agree on the deal with the division of assets and liabilities after a relationship has ended.

Consent orders are meant to be an efficient, accessible, and enforceable way for parents from all walks of life to decide on the plan for their future. Even though they are signed off by the Family Court, you won’t have to go to court to get them put in place.

The key thing to know about consent orders is that both parties have to jointly agree to their terms, and submit the Application for consent orders to the Family Court. You can get a lawyer to help you negotiate the terms you’ll agree to and draft the forms you need to make this application, or you can do it yourself.

Trying to navigate the legal system when you’re going through a separation or a divorce doesn’t have to be frustrating and confusing. Our Simple Article & Infographic should help clarify a few misconceptions...

Whilst the decisions you make at this point in your life will affect your family’s future, it is possible to move forward feeling confident that the agreements you sign will protect your family.

When you’re ready to divide your property, there are two ways to turn your decisions into a legally binding agreement:

On this page, we’ll help you understand the differences between these two courses of action, as well as the advantages and disadvantages of each option - our helpful infographic below should help illustrate the main points you should keep in mind when deciding.

We’ll also be answering some commonly asked questions about creating consent orders and signing a Binding Financial Agreement after separation or divorce.

Or, if you’d prefer to talk to someone about your situation you can reach out to the team at Melbourne Law Studio for family law advice. We offer online and in-person consultations, simply call (03) 9021 1421 or book online now.

Whether you are in the process of getting a divorce or separating, “consent order” is a phrase you will no doubt become familiar with. A consent order is a written agreement between separated spouses that gets approved by the Family Court. They can address financial matters such as property and superannuation as well as parenting.

Where parenting is being agreed upon, this agreement contains arrangements for how you will both parent your children moving forward, including how parents will:

You can’t, however, include anything related to child support in consent orders - those arrangements need to be outlined in a Parenting Plan or assessed by Services Australia.

Where property is concerned, consent orders are used to agree on the deal with the division of assets and liabilities after a relationship has ended.

The consent order part of binding financial agreement vs consent orders are meant to be an efficient, accessible, and enforceable way for parents from all walks of life to decide on the plan for their future. Even though they are signed off by the Family Court, you won’t have to go to court to get them put in place.

The key thing to know about consent orders is that both parties have to jointly agree to their terms, and submit the Application for consent orders to the Family Court. You can get a lawyer to help you negotiate the terms you’ll agree to and draft the forms you need to make this application, or you can do it yourself.

Binding Financial Agreement Vs Consent Orders

If you’re going through a separation and consent orders are a possibility you’re exploring, it helps to know the advantages of these agreements. Usually, the benefits of consent orders (for finances or parenting) after separation include:

Although consent orders are made by agreement, they do prompt parties to seek independent legal advice before they are lodged with the Court. Not all agreements are automatically accepted by the Court as they have to be just and equitable. It is a great idea to get in touch with a lawyer once you have reached an agreement to get the final tick of approval. If you provide a completed form it may help to reduce the legal fees because the material has already been provided.

There aren’t a great deal of disadvantages to getting consent orders after a separation or divorce, however, they do have two major drawbacks if you aren’t careful or don’t get the right advice:

Binding Financial Agreements are a more formal route to agreement.

https://youtu.be/UhN-9qenpvw

[elementor-template id="3537"]

Binding Financial Agreements are very different to consent orders. They are a civil agreement on the division of your finances, and as such do not cover parenting issues. Instead, Binding Financial Agreements are a way for two people to formally agree on how their property, superannuation, other assets, and liabilities will be divided if separation takes place.

While some people choose to get a Binding Financial Agreement after divorce, these agreements can be made at any stage of the relationship. When couples enter into a BFA before they marry this is often called a “prenup”.

You don’t have to lodge your Binding Financial agreement once it's made - you only need to get the Family Court involved if you need them to enforce the terms you’ve both agreed to.

The most important thing to know about signing a Binding Financial Agreement is that once you enter into this contract, you may compromise your right to have a family court make decisions that contradict the terms you’ve outlined in your agreement.

When you consider getting a Binding Financial Agreement after separation in, it’s important to know whether this type of arrangement will work to your advantage. Typical reasons people get a Binding Financial Agreement include:

As with all legal arrangements, there are disadvantages to choosing to enter into a Binding Financial Agreement. These include:

To make your family law consultation as productive and informative as possible, you may want to first get answers to some of the most frequently asked questions about Binding Financial Agreements.

A consent order is a written agreement between separating spouses that gets approved by the Family Court. Consent orders can address parenting arrangements for children as well as financial matters, property and maintenance.

The Family Court of Australia looks after all applications for consent orders. After the Registrar has reviewed and approved your application and attached documents, you’ll be given a sealed set of papers (in the mail or online) outlining your financial and parenting agreements. These papers are called consent orders. For more information, Victoria Legal Aid has an easy-to-digest explanation of consent orders which you may find useful.

A consent order is legally binding, which means that if you break the terms and conditions outlined within it, a court can penalise either party for not following the consent orders they have agreed to.

You can write your own consent orders at no cost, and then simply pay the $165 filing fee to have them submitted to the Court. The disadvantage of this approach is that, if your consent orders aren’t granted, you’ll have to start the process all over again.

Unlike Binding Financial Agreements, there is no legal requirement to get a lawyer to draft, witness, or submit your consent orders.

However, if there is a large or complex asset pool involved, it’s a good idea to get legal advice. For example, if you’re looking to sell property, the Office of State Revenue will require particular wording in your consent orders before you’re granted any tax concessions. This is also true for the Trustee’s of Super Funds where Super Splitting Orders are being sought.

If you believe that the consent order is not fair to one party, a solicitor can help you work on making the terms of the agreement more equitable and therefore more likely to be approved by the Registrar.

The Family Court of Australia website is a great resource for information on the consent order application process. The basic steps are:

Seek legal advice on what orders to apply for (e.g. spousal maintenance, parenting, financial)

Work with your former spouse to figure out what you’d like to include in your consent orders

Fill out your Application for consent orders form, the Application for consent orders - proposed orders template, and, if relevant, the Superannuation information kit and Notice of child abuse, family violence or risk form.

Lodge your Application for consent orders form online along with the required number of copies of the above documents and pay the $170 application fee

After you’ve applied, the Registrar will either approve your application and return sealed orders, or notify you that your application has been declined.

Alternatively, you can get help from a lawyer who will not only give you the advice you need, but manage the above process for you.

A Binding Financial Agreement is essentially a contract between you and your former partner that lays out how your assets will be pided if your relationship breaks down.

You can expect your lawyer to draft your Binding Financial Agreement within one to two months of you signing your client services agreement with them. The exact time it takes will depend on how quickly you can get your lawyer the documents they need, the complexity of the agreement, and whether any special clauses need to be inserted. The time it takes your ex-spouse to comment on the document and agree to the final version is also a contributing factor.

The cost of your Binding Financial Agreement will depend on how complicated your finances are. For example, Binding Financial Agreements involving businesses, trusts, and other sophisticated financial arrangements cost more to create than Binding Financial Agreements with a straightforward pision of simple assets.

You should also know that Binding Financial Agreements are complex, and not every lawyer is capable of drafting them. Due care and skill is needed to make these agreements stand up in court. As a result, these agreements can be somewhat costly. While legal advice can seem like an onerous expense, it is only a fraction of what it will cost to take your former partner to court after your relationship has broken down.

While you may find it useful to read over a Binding Financial Agreement template, when it comes to actually creating a Binding Financial Agreement, Victoria has laws that force both parties to get legal advice.

The process is as follows:

1. One or both parties will hire their own independent family lawyer to draft their Binding Financial Agreement. Before doing this, it can be useful to look for a Binding Financial Agreement example, so you know what to expect from the document.

2. Negotiations regarding the terms of the agreement will begin. Each party’s lawyer must explain to them how the Binding Financial Agreement will affect their rights, and outline the advantages and disadvantages of signing.

3. Once the terms have been agreed upon and the final Binding Financial Agreement is in writing, both parties need to sign it.

4. Both parties’ lawyers need to attach a signed statement saying their client understands the advantages, disadvantages, and effects upon their rights that the Binding Financial Agreement has.

5. All parties are given a copy of the Binding Financial Agreement. This is the document that will be relied upon should either party need to ask the court to enforce particular terms.

Binding Financial Agreements can cover as many or as few financial issues as you and your former spouse want. Key elements of a typical Binding Financial Agreement are:

- Both party’s full names, addresses, occupations and dates of birth

- An outline of the timeline of your relationship

- A list detailing all of your assets (e.g. property, income, bank account funds) and liabilities (e.g. mortgages, personal or business loans) and their values

- Details of other financial resources such as superannuation holdings or trust payments

- Instructions on how your assets and liabilities will be dealt with after a relationship breakdown

- Provisions for how the agreement might be altered if circumstances change

- Signed and witnessed signatures of all the parties involved

Unfortunately, it is not uncommon for Binding Financial Agreements to be set aside if they have not been drafted properly. The court may overturn your Binding Financial Agreement if:

- One or both parties were withholding information that was relevant to the agreement when it was signed. For example, if your partner does not disclose all of their assets in the agreement, the Binding Financial Agreement may be set aside.

- Either party obtained the agreement by fraud or duress. For example, if one party gives the other an ultimatum to sign the agreement or they will call off their wedding, this can be seen as duress.

- The agreement was made so that a creditor could be defeated or defrauded.

Both parties agree to terminate the agreement, obtain independent legal advice, and then sign a “Termination Agreement”.

- The agreement is no longer practical to carry out because either parties’ circumstances have significantly changed.

- Fulfilling the agreement would result in hardship for the children involved or will affect their care or welfare.

When a Binding Financial Agreement is overturned, both you and your former spouse can seek alternative agreements, through a property settlement, consent orders, or another Binding Financial Agreement.

A good place to begin your research is our blog on the 7 Steps to Getting a divorce in Australia. There you’ll find a practical guide to navigating the process, from when you first decide to divorce through to entering into final agreements about your property, finances, and children.

If you need help understanding whether a Binding Financial Agreement or consent orders are right for your situation, Melbourne Law Studio can provide you with honest and trustworthy Family Law Advice.

Your family deserves a tailored solution, which is why the first thing we ask is, “What’s your situation?”. To make the separation process easier for you, we can provide:

- Fixed fees: Understand the costs involved from the beginning.

- Payment plans: Ask us about paying in instalments.

- Flexible appointments: We can work around your schedule.

- Easy to understand language: Find out exactly what you need to know.

Plan the next step with an online or in-person consultation today.

Call (03) 9021 1421 to book your consultation, or schedule your appointment online now.

Book your one-hour strategy session, online or in-office, for personalised legal advice tailored to your situation.

Fixed fee: $550 (incl. GST).

Send us a message using the form below.